Summary

Take a few minutes to think about your engagement approach. After the March Turnover Tide subsides, you might be glad that you did.

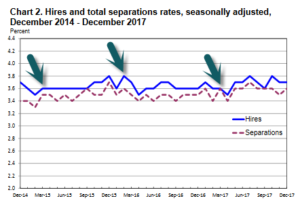

According to the US Bureau of Labor Statistics, who have been fastidiously tracking turnover with their JOLT (Job Openings & Labor Turnover) report since 2014, there is a slight but significant uptick in employee turnover and job openings that occurs fairly regularly between the months of December and March.

Quitting in December makes sense – the end of the year is a natural wrapping-up point. But what could be going on in March? While there are many factors that affect turnover and this analysis is far from scientific, one can make a good case that the March spike is at least partially influenced by annual bonus payouts.

Accountants may know March 15 as Section 409A Day, referring to a wrinkle in the tax code that says if an organization has an annual bonus structure, they must make all payouts for the current year by March 15 in the following year.

Ergo, if employees are promised bonus compensation at the end of 2017, a fat penalty awaits anyone who drags their feet on payment until March 16, 2018. Any organization with a tax strategy for annual bonuses is likely aware of this and has a regular date or time window established to be in compliance with Section 409A.

However, savvy job-hoppers always look for ways to maximize their benefits before they leave a company, and many will wait out bonuses before leaving. Hacking your job hunt is now a thing. This could be a big reason we see the December spike in employee turnover carry over into March.

So maybe that employee you thought was going to stick around at the end of the year is just waiting for the right time to cash out. There’s nothing wrong with this in itself and employees shouldn’t be judged for it. There might not even be anything you can do to stop it from happening.

But one thing you can do is use March as a handy milestone to reflect on how you approach extrinsic (cash, tangible) versus intrinsic (pride, accomplishment, intangible) motivation. A balanced approach to engagement, i.e. offering a healthy variety of physical and psychological rewards, is the best insurance policy against turnover, no matter the time of year, and achieving a more perfect balance can better treat the root cause and might even win over some job-hoppers.

Start by asking yourself these questions:

Do employees look forward to workplace rewards as much as they do cash bonuses?

Cash bonuses are always welcome, but too quickly forgotten. Non-tangible rewards can create more lasting memories, better strengthening bonds. They need not eclipse the popularity of cash, only feature some desirable alternatives that hold enough interest.

Are there enough daily opportunities on the job to reward employees intrinsically?

Bonuses are transactional – they show up in a pay stub after the fact. More visible, timely, and psychologically motivated gestures are needed for people to feel properly rewarded. This requires actively creating opportunities to show appreciation in person, with daily rewards tied to intangibles like discretionary effort, culture, and company vision.

Do managers make a habit of personally thanking employees and/or giving out non-cash awards?

Managers bear much of the responsibility for engaging frontline employees, and must have a system worked out for rewarding employees mentally and spiritually to balance out transactional rewards. The more regular moral support becomes in the workplace, the more attractive it is, and bonuses are icing on that cake.

Take a few minutes to think about your engagement approach this month. After the March Turnover Tide subsides, you might be glad that you did.